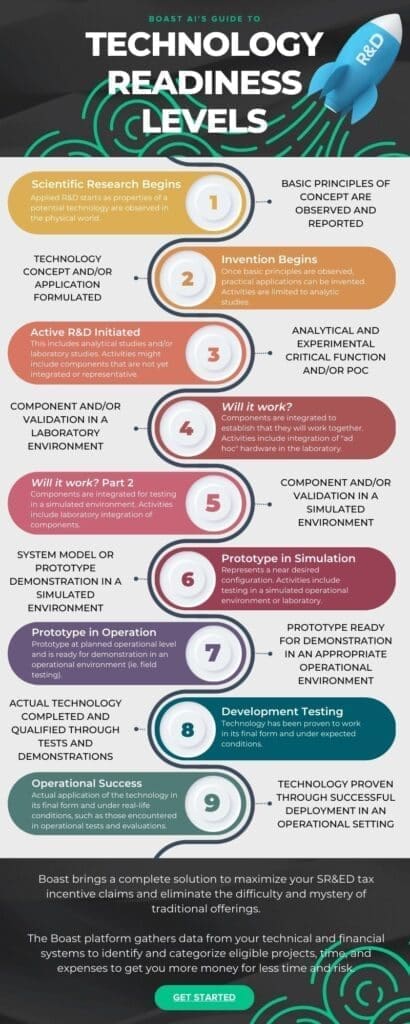

Technology Readiness Levels (TRLs) are a widely recognized way to measure the technical maturity of an innovation.

In the startup and funding world, TRLs make it easy for both engineers and non-technical stakeholders to quickly see where a proprietary technology stands along the Research, Development, and Deployment journey, on a scale from 1 to 9. TRL 1 marks the beginning of research, while TRL 9 means the technology is fully ready for production.

Originally created by NASA to track progress in space technology, the TRL framework is now used worldwide—including by the European Union and the Canadian federal government. The criteria for each TRL are largely consistent no matter where you are.

Because of this, TRLs have become a go-to tool for internal development teams everywhere. They help teams plan product roadmaps, allocate resources, and prepare for the next stage of R&D.

Whether startups are seeking government grants—which use TRL as a qualifying factor—pitching their innovation to venture capitalists, or getting ready for an acquisition, TRLs help clarify where they stand.

Whether or not innovative companies use this information to raise equity, it’s crucial for founders, CFOs, and product leaders to understand what each TRL involves and what’s required to move up from one level to the next.

How TRLs affect your funding options

In Canada, the government groups the nine TRLs into four main stages of technology development:

- Fundamental Research (TRL 1-2)

- Research and Development (TRL 3-5)

- Pilot and Demonstration (TRL 6-8)

- Early Adoption (TRL 9)

These stages are especially valuable for businesses using government funding like tax credits and grants in Canada, since they act as a shortcut to estimate the maximum and minimum funding an organization could qualify for.

There’s also the Industrial Research Assistance Program (IRAP), which provides advisory services and financial support to drive Canadian innovation. IRAP mainly targets early-stage SMBs, helping them bring their innovations to market.

IRAP funding usually tops out at around $150,000, though exceptions are made in some cases. To be eligible, your business must:

- Canadian SMBs that are incorporated and focused on profit

- Have 500 or fewer full-time employees

- Be committed to developing and commercializing innovative, technology-driven products, services, or processes in Canada.

To qualify, you’ll need to meet these requirements and work directly with a local Industry Technology Advisor to build your innovation story—including your past, current, and projected TRL status.

Boast offers a complete solution to help you maximize your tax incentive claims and take the guesswork out of the process. Your data—lots of it—drives a more accurate claim. Boast connects securely with hundreds of systems, making it easy and instant to capture and qualify your SR&ED investments. Request a demo with our team today to get started.