What is the Computer Manufacturer R&D Tax Credit?

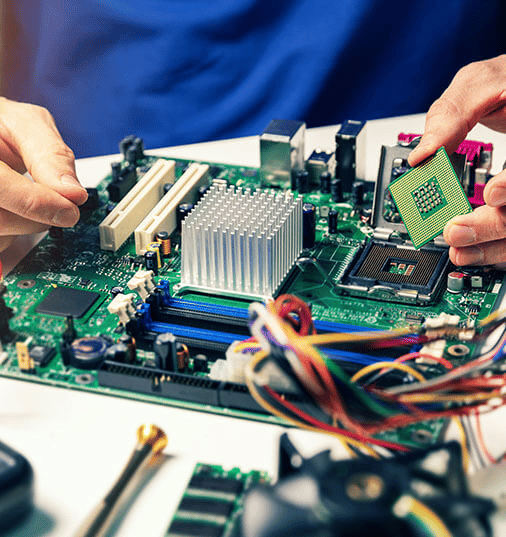

The computer manufacturing industry has been one of the most important and innovative industries. Machines and many computer-aided manufacturing processes have taken the place of much manual labor in production and delivery. With all these new techniques and advancements, research and development (R&D) remain an important component of the computer manufacturing sector.

Manufacturers must invest in new technologies and processes to stay competitive. Much of its financing is spent developing faster, more efficient, and more reliable machines.

The Computer Manufacturer R&D Tax Credit is a federal tax credit available to businesses engaged in the process of experimentation to create new or improve existing goods or services. Whether you’re involved in software development or other research activities, the R&D tax credit can help you save money while investing in your company.

Computer R&D Funding and Tax Credits

The Canadian government offers several tax incentives to encourage computer businesses to invest in research and development. One of these is the Scientific Research and Experimental Development tax credit, which can refund up to 35% of eligible R&D expenditures.

The Scientific Research and Experimental Development (SR&ED) tax credit is a refundable tax credit that encourages Canadian businesses of all sizes and related industries to conduct R&D. The Canada Revenue Agency runs the program and is the major source of federal government funding for industrial research and development in Canada.

- A project must fulfill three basic criteria to be eligible for the SR&ED tax credit:

- It must be undertaken to achieve technological advancement.

- It must involve some element of scientific or technical uncertainty.

- The work must entail a systematic investigation and must include a thorough study or search to eliminate the uncertainty.

The National Research Council of Canada offers grants and funding for R&D projects in various sectors, including information and communications technologies.

The tax benefits are not the only reason to invest in computer R&D. You can develop new goods and services that will appeal to customers by staying ahead of the competition, allowing you to stay at the forefront of innovation. These incentives will also enable firms to develop and expand continually, which would aid in the creation of additional employment and economic revitalization in Canada.

Computer Aided Manufacturing Tax Credit

The Computer Aided Manufacturing (CAM) tax credit is a federal tax credit that encourages businesses to invest in CAM technologies. The credit is equal to 10% of the cost of new or upgraded equipment, up to a maximum of $500,000. To be eligible, businesses must use the equipment for manufacturing purposes.

The CAM tax credit was created to encourage businesses to invest in new technologies to improve their manufacturing processes. The CAM tax credit is intended to cover a portion of the expenses associated with upgrading or purchasing new equipment, and it can be used to offset the cost of training employees on how to use the new equipment.

A company must be engaged in the design or modification of metal or non-metal components, tools, dies, molds, or patterns using computer-aided design (CAD) or computer-aided engineering (CAE) software to qualify for the CAM tax credit.

The CAM tax credit will help reduce the cost of developing these new products by offsetting the cost of software upgrades. The credit is available to businesses of all sizes, including startups.

Eligible expenses and qualifying activities for the CAM tax credit include:

- Salaries and wages paid to existing and additional employees who are directly involved in the eligible R&D activities;

- Materials and supplies used in the eligible R&D activities;

- Contractors and consultants engaged in working on the eligible R&D activities; and

- Overhead expenses incurred as a result of the eligible R&D activities.

PC Manufacturing R&D

Production of personal computers has become more competitive, and companies are looking for ways to improve their products and remain profitable. Global PC shipments declined by 7.6% in the fourth quarter of 2016, the ninth consecutive quarter of decline.

PC manufacturers must continue to invest in R&D and develop new ways to innovate their products. The leading companies in the industry have all increased their R&D spending to maintain their market share.

The PC Manufacturing R&D Tax Credit is a refundable tax credit available to businesses of all sizes engaged in the R&D for new or improved products, processes, or software for use in the production of personal computers. The research credit allows a company to get up to 20% of their payroll taxes back, making it an important source of funding for businesses.

To be eligible, a corporation must be carrying on business in Canada. It must have incurred an an eligible, qualified research expenses regarding research and development activities undertaken in Canada.

Valid expenses include salaries or wages paid to employees engaged in R&D activities and contract payments made to arm’s length parties for qualifying R & R&D services. The credit is claimed in the year in which the expenses are incurred. Unused credits can be carried forward for up to 10 years or 3 years back.

There are several ways for technological companies and startups to receive funding in Canada. With the variety of tax incentives available from the government, the sustainability of the computer industry can be strengthened, and new strategies for innovation can be discovered with additional resources for new procedures.

How We Can Help

Claiming taxes and recovering from all research and development costs is a tedious task, but it becomes a lot easier with the Boast software platform. Our team of engineers and accountants came up with a way to fast-track all preparation and estimates of clients throughout the year, helping them claim larger refunds with only minimal audit risk.

Automated R&D Tax Credits for Computer Manufacturing

- Payroll

- Accounting

- Jira

- Github

The Boast platform gathers data from your technical and financial systems to identify and categorize eligible projects, time, and expenses—estimating along the way instead of only at the end—and getting you more money, faster, for less time, and risk.

- Time Tracking

- Cash

- Audit Evidence

- Tax Forms

Frequently Asked Questions

Q:Who is eligible for the R&D tax credit?

Q:What types of activities qualify for the R&D tax credit?

- Developing or improving computer hardware products

- Designing and testing new computer hardware prototypes

- Conducting qualified research into the new or improved product and manufacturing processes for computer hardware

Q:Are there any other requirements that must be met to claim the research tax credit?

Q:What are the benefits of claiming the R&D tax credit?

Q:How can we claim the tax credits?

Find Out How Much Money You Can Get From The Government

Your free 1-hour consultation includes a detailed review of our platform, your projects, processes, and financial data by one of our R&D Tax experts.

Talk to one of our experts to see how outsourcing your R&D tax claims to Boast can get you more money back from the government and help you regain the time you need to run your business.

Fill out the form to schedule your demo.