What is the Medical Device R&D Tax Credit?

Medical devices are products that may assist with the diagnosis, cure, mitigation, or prevention of disease or other ailments. They range from simple devices such as sensory aids to complex devices that transmit healthcare data. Each product plays a vital role in the healthcare system, depending on its intended use. If you plan to develop or improve medical devices, you can apply for tax credits.

The Medical Devices R&D Tax Credit allows medical device companies to receive a credit for expenses related to the R&D of new devices. It can be used to offset the cost of R&D and make it easier for healthcare companies developing applications to create new products or improve them. Healthcare companies must have incurred qualified research expenditures related to designing, testing, or prototyping new devices to be eligible.

This tax credit is a key instrument for supporting medical devices’ technological advancement. The credit options can help companies develop new and better products that improve patient care in the healthcare industry by making it easier for them to invest in innovative medical technologies.

Medical Device Manufacturing Funding and Tax Credits

The Medical Devices R&D Tax Credit can be claimed for expenses incurred in Canada, and the Canadian government offers a range of funding and credit programs to support manufacturers.

The Manufacturing Innovation Fund (MIF) is a competitive program that provides financial support to small and medium-sized enterprises (SMEs) for projects that accelerate the adoption of innovative manufacturing technologies and processes.

The MIF has two components:

- The Technology Adoption Component provides funding for up to 50% of eligible project costs, to a maximum of $5 million per project, to adopt new manufacturing technologies and processes; and

- The Process Improvement Component provides funding for up to 75% of eligible project costs, to a maximum of $7 million per project, for process improvements that increase competitiveness and productivity.

The Canadian government also offers other tax credits that can benefit manufacturers, including the Scientific Research and Experimental Development (SR&ED) Tax Credit and the Investment Tax Credit (ITC).

The SR&ED Tax Credit is a refundable credit supporting companies engaged in scientific research and experimental development activities. The ITC is a non-refundable credit that can be used to offset taxes payable on eligible investments in manufacturing or processing machinery and equipment.

The Medical Devices Fund (MDF) was also established, which provides financial assistance to SMEs for the early-stage adoption of emerging medical technologies with great potential for health benefits and commercial success. The MDF is a repayable contribution of up to $1 million per project, with a maximum of $5 million per company.

Medical Alert Devices Development

Medical alert devices were created to assist persons with health problems to communicate in an emergency. Today, medical alert devices are used by those with hearing impairments, visual impairments, and other disabilities.

They come in several types, from simple buttons worn around the neck to more complex systems with a base unit and a variety of sensors. Some devices are designed to be worn all the time, while others are only suitable for use when you are not at home. You can pick from a variety of options depending on your needs.

These devices are one type of product that is accepted for the R&D tax credit. To be eligible, the device must meet certain criteria set forth by the Internal Revenue Service (IRS). For example, the device must be used for diagnostics, treatment, or disease prevention. It must be intended for use in humans, and it must represent a significant advance over existing technology.

Medical Device Manufacturing Certification and R&D

To bring a new medical device to market, manufacturers must get certification from the Food and Drug Administration (FDA). The process of obtaining FDA approval can be lengthy and expensive, and it is often necessary to conduct extensive R&D to meet the FDA’s standards. Manufacturers may, however, be eligible for an R&D tax credit, which can help subsidize some of the costs of FDA approval.

The R&D tax credit can be a valuable tool for medical device manufacturers, and it can help cover some of the costs of bringing a new product to market. To claim the tax credit, manufacturers must first obtain certification from an accredited body that has conducted sufficient R&D on their product. Once they have received certification, they can apply for the tax credit.

Medical device manufacturers must meet strict quality standards to ensure the safety and efficacy of their products. One way to demonstrate compliance with these standards is through certification by an independent third-party organization, such as ISO 13485 or ISO 9001.

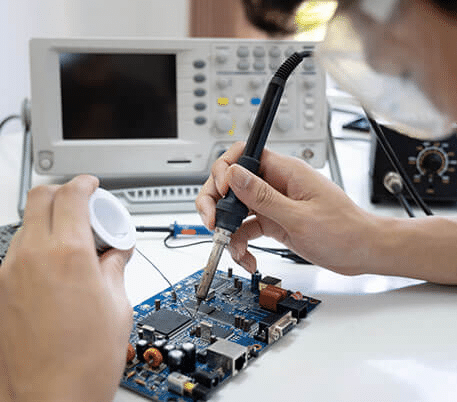

In addition to certification, medical device manufacturers must also invest in R&D to create new and innovative products that meet the ever-changing needs of healthcare professionals and patients. R&D can be expensive and tedious, but it is essential for the continued success of the medical device industry.

The manufacturing of these devices is a highly regulated industry. To ensure the safety and efficacy of these products, manufacturers

must comply with stringent quality standards. One way to demonstrate compliance with these standards is through certification by an independent third-party organization.

How We Can Help

Boast can assist companies in receiving comprehensive estimates for their R&D tax claims. Our team of specialists and our software platform have aided our clients in accelerating and securing refunds faster and safer.

Automated R&D Tax Credits for Medical Devices

- Payroll

- Accounting

- Jira

- Github

The Boast platform gathers data from your technical and financial systems to identify and categorize eligible projects, time, and expenses—estimating along the way instead of only at the end—and getting you more money, faster, for less time, and risk.

- Time Tracking

- Cash

- Audit Evidence

- Tax Forms

Frequently Asked Questions

Q:Who is eligible for the Medical Devices R&D Tax Credit?

Q: What expenses are allowed for the Medical Devices R&D Tax Credit?

Q:Are there any restrictions on using the Medical Devices R&D Tax Credit?

Q:How long do I have to Claim the Medical Devices R&D Tax Credit?

Q:Is there anything else I should know about the Medical Devices R&D Tax Credit?

Find Out How Much Money You Can Get From The Government

Your free 1-hour consultation includes a detailed review of our platform, your projects, processes, and financial data by one of our R&D Tax experts.

Talk to one of our experts to see how outsourcing your R&D tax claims to Boast can get you more money back from the government and help you regain the time you need to run your business.

Fill out the form to schedule your demo.