Each year, the US government provides billions of dollars to innovative businesses for developing new or improving existing technologies, products, materials, and processes through the R&D Tax Credit program.

Qualified small businesses and startups can use the R&D tax credits to offset up to $250,000 per year in social security taxes, which typically comes as a refund check from the IRS.

Since every business needs capital for innovation and growth, claiming R&D tax credits is one of the cheapest ways to maximize capital and reduce tax liabilities.

What is R&D Tax Credit?

The R&D Tax Credit program is a general business tax credit under Internal Revenue Code section 41 for companies that incur research and development costs in the United States and has been around since 1981. Under the R&D Tax Credit program, the US government provides billions of dollars every year to innovative businesses for developing new or improving existing technologies, products, materials, and processes.

What Can You Recover with R&D Tax Credits?

The R&D tax credits you can recover can be broken down into two parts – federal and state. The Federal portion is approximately 10% of eligible expenditures that can be used to offset Social Security taxes up to $250,000 per year, income taxes, or alternative minimum tax (AMT). However, the State portion differs from state to state.

R&D Tax Credits in New York

In New York, the state credit is capped at 3% of qualified research expenses. However, taxpayers can claim up to 50% of their federal R&D credit that relates to any R&D expenditures in the state of New York. In addition, there are a number of tax credit programs available to businesses for job creation, expansion, and foster innovation. Businesses can partake in the Excelsior Jobs Program, Start-Up NY, Life Sciences Tax Credit Program, and more. A full list of tax credits can be found here.

For example, as part of the Excelsior Jobs Program, the credit is for companies in fields such as biotech, pharmaceutical, high-tech, clean technology, financial services, agriculture, and manufacturing that make significant capital investments or create jobs.

Every business approved for participation in the Excelsior Job Program is also eligible to apply for the jobs tax credit and investment tax credit. Some businesses may also be eligible for the real property tax credit.

Part of the eligibility criteria to claim the state R&D tax credit requires companies to create net new jobs, based on the industry they serve:

- Scientific R&D: at least 5 net new jobs.

- Software Development: at least 5 net new jobs.

- Agriculture: at least 5 new jobs.

- Manufacturing: at least 10 net new jobs.

- Financial services (customer service) back-office operations: at least 50 net new jobs.

- Distribution: at least 75 net new jobs.

- Music Production: at least 5 net new jobs.

- Entertainment: at least 100 net new jobs.

- All other types of companies must create at least 300 net new jobs and be investing at least $6 million.

What You Need to Claim New York’s State R&D Tax Credits

The New York state tax credits can only be claimed if the tax returns are filed on a timely basis. In order to receive a certificate of tax credit for subsequent taxable years, the participant must submit a performance report demonstrating that it continues to satisfy the applicable eligibility requirements within 30 days of the end of its taxable year.

To be eligible for the R&D tax credit, there are strict guidelines and requirements to adhere to. For example, activities that qualify for the tax credit must pass a 4-part test examining the following aspects: Permitted Purpose, Elimination of Uncertainty, Process of Experimentation, and Technological in Nature.

Lastly, the company must complete Form RPD-41298, Research, and Development Small Business Tax Credit Claim Form, and Development Tax Credit and submit it along with their CRS-1 Form. Excess R&D Tax Credit is refundable and credit may only be claimed by eligible businesses over a 10-year period.

FIND OUT IF YOU QUALIFY FOR R&D TAX CREDITS – FREE ASSESSMENT

New York R&D Tax Credit Case Study

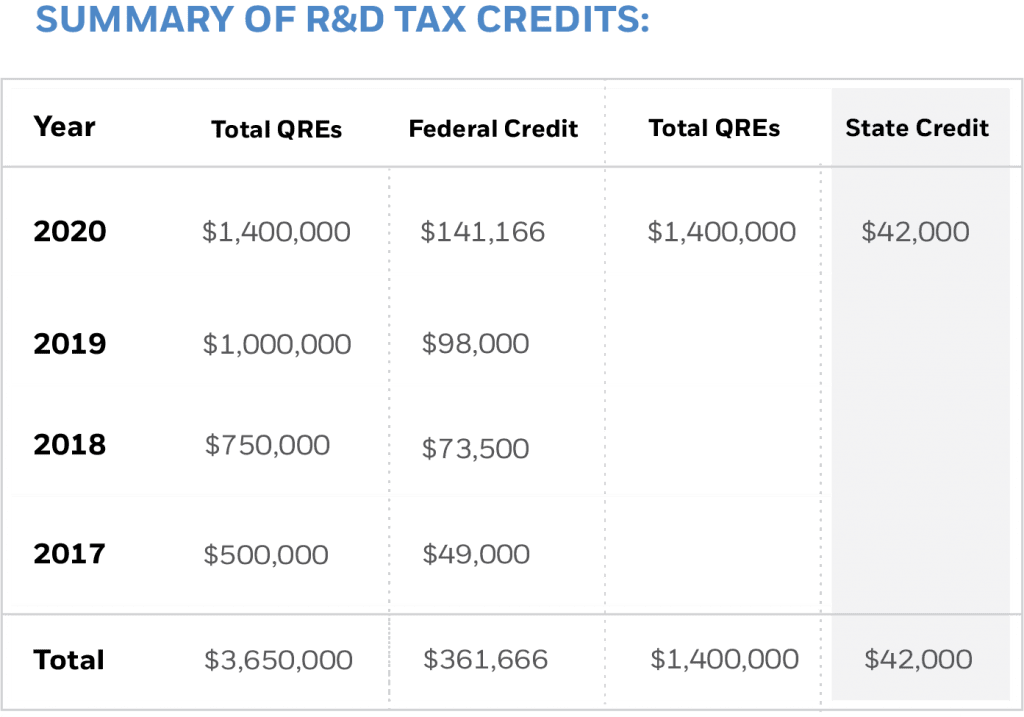

A New York pharmaceutical company had never before claimed the R&D credit. This project involved a multi-year study covering the years 2017-2020. Based on total Qualified Research Expenditures (QREs), the company qualified for the federal R&D Tax Credit of $361,666 and an additional $42,000 of state R&D Tax Credit in New York.

Benefits of Claiming R&D Tax Credits

Claiming R&D tax credits has many attractive benefits. Firstly, the R&D tax credits can be used to offset the employer portion of your Social Security taxes up to $250,000 for each fiscal year.

The Social Security tax offset allows qualified small businesses to receive a benefit for their research activities regardless of profitability. R&D tax credits can also be used to offset income taxes if you are in a taxable position, which is dependent on your previous tax return statements.

In addition, the R&D tax credits can be used to offset the AMT if you have less than $50 million in average revenue for the 3 preceding years from the tax year, and you owe AMT in the current year.

Preparing Documentation for R&D Tax Credit

Although the R&D Tax Credit program can potentially help your business recover large amounts of your research and development spend, claiming the tax credits is a complicated process.

There are multiple forms and documentation that you will need. Additionally, documentation also has to adhere to strict criteria, such as:

- It has to be contemporaneous which means it has to be documented at the time the R&D was done. The bigger the claim, the more documentation you would want to have.

- Your documentation must also be dated. You need to prove that the work occurred in the fiscal year you are claiming.

- Your claim needs to highlight technical challenges such that it substantiates the R&D that was done.

Work with Boast.AI for your R&D Tax Credits

Given the complicated process of claiming tax credits, consider working with our Boast.AI team. Boast.AI helps innovative businesses automate the complicated process of claiming R&D incentives. By combining AI-driven software with in-house R&D tax experts, we can help your company get larger returns without the grunt work and audit risk.

With engineers and finance professionals armed with over 20 years of experience in this field, our team has extensive knowledge about the R&D Tax Credit program. We will stay engaged throughout the year to help you identify R&D eligible work on an ongoing basis, enabling us to provide information on other technology grants and financing opportunities.

Moreover, in the event of an R&D review by the IRS, we will defend you in the process and help to ensure that your claim is successful. Get in touch with us now to request a free assessment and get started on your next R&D claim.