What is a Start Up Business Grant?

A start up business grant is a sum of money awarded to a new business that is in the early stages of development to help with costs of getting started. These grants can be used for a variety of purposes, such as marketing, research and development, support for training costs, expansion project, or hiring new employees.

There are a number of different start up business grants available, each with its own set of eligibility requirements. One of the best ways to find start up business grants is to check with your local government or economic development agency. They often have a list of available grants that you can choose from.

Grants do not compare to business loans. Small businesses or non profit organizations do not have to pay for interests in return. Essentially, grant is free money. There are many resources available to help you start up your own business, so don’t hesitate to take advantage of these grant opportunities. New businesses are essential for job creation and could contribute significantly to economic growth.

2.The Export Development Canada that helps businesses export their products and services;

3. the Atlantic Canada Opportunities Agency that provides funding for businesses in Atlantic Canada; and

4. the Western Economic Diversification Canada that offers funding for businesses in Western Canada.

There are also private grant providers that offer funding for a wide range of business activities. Some popular grant providers include:

- The Canadian Innovation Commercialization Program that provides grants and support services to small and medium-sized businesses that are innovating new products, processes or services;

- The National Research Council of Canada that offers research and development grants for businesses; and

- the Women’s Enterprise Initiative that provides financing and mentorship to women entrepreneurs.

Are you Eligible for Start up Business Grants in Canada?

To be eligible, businesses must meet certain criteria. For example, the grant may be restricted to businesses that are located in a specific geographic area or that are owned by members of a certain demographic group. Submission of a business model or business plan that will undergo a review process is a requirement.

Canadian small business grants also exist for businesses that have been in operation for a minimum of two years. Financial assistance provided by the Canadian government usually comes in the form of a contribution, not a business loan. The government does not expect repayment of the grant, and there are no interest rates or fees charged.

The Canadian government offers a wide variety of grants for businesses at all stages of development, from start-ups to well-established companies. A list of current business grants offered by the Canadian government can be found on Grants Canada.

At a minimum, businesses must meet specific criteria in order to be eligible applicants for government grants in Canada. In general, businesses must:

- Be incorporated or registered as a sole proprietorship;

- Be located in Canada;

- Have a permanent business address; and

- Conduct activities that contribute to the economic development of Canada.

Some grants are also available to Canadian companies who wish to start a business abroad. Canadian entrepreneurs usually have access to more funding opportunities than those in the United States expecting from federal grants.

How We Can Help

With the help of our team of engineers and accountants, Boast helps clients claim their research and development costs from the government with minimal audit risk. Boast’s exclusive software platform allows companies to manage, prepare, and estimate costs throughout the year to get higher claims much faster and with high accuracy.

Access Your SR&ED Refund Up To 12 Months Early So You Can:

- Re-invest in your business

- Grow faster

- Hire sooner

- Extend your cash runway

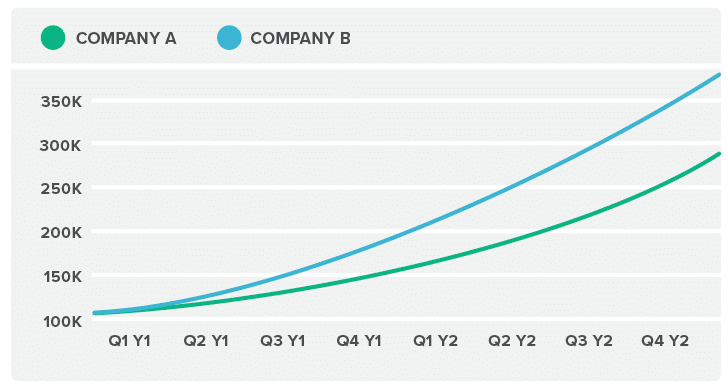

Companies that leverage QuickFund grow much faster than their counterparts

Since company B was able to leverage SR&ED Financing to get quarterly advanced funding, they were able to increase their growth rate one year ahead for Company A.

2 APPLY

3 GET FUNDED

4 GROW

How Would You Invest Your SR&ED Refund If You Got It Today?

Use our calculator to estimate the value of our quarterly advances and unlock your R&D expenses to improve your cash flow.

With our founder-friendly platform, it takes only one to two weeks to get funding.

Apply Now

Frequently Asked Questions

Q:How do I qualify for the R&D Tax Credit?

- Developing new or improved products, processes, or services

- Testing prototypes or models

- Developing software

- Engineering

- Commercializing new technologies

Q:How much can I claim with the R&D Tax Credit?

Q:What is the best type of R&D Tax Credit for your business?

Q:How much can I save with the R&D Tax Credit?

Q:What expenses are eligible for the credit?

Find Out How Much Money You Can Get From The Government

Your free 1-hour consultation includes a detailed review of our platform, your projects, processes, and financial data by one of our R&D Tax experts.

Talk to one of our experts to see how outsourcing your R&D tax claims to Boast can get you more money back from the government and help you regain the time you need to run your business.

Fill out the form to schedule your demo.