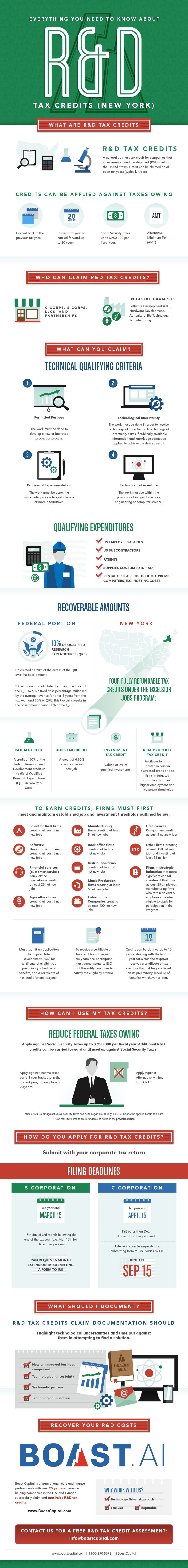

New York offers four fully refundable tax credits under the Excelsior Jobs Program in addition to the Federal R&D tax program:

- Research and Development (R&D) Tax Credit: A credit of 50% of the Federal Research and Development credit up to six percent of Qualified Research Expenditures (QRE) in New York State.

- Jobs Tax Credit: A credit of 6.85% of wages per net new job.

- Investment Tax Credit: Valued at 2% of qualified investments.

- Real Property Tax Credit: Available to firms located in certain distressed areas and to firms in targeted industries that meet higher employment and investment thresholds.

To earn credits, firms must first meet and maintain established job and investment thresholds outlined below:

- Scientific R&D firms creating at least 5 net new jobs

- Software Development firms creating at least 5 net new jobs

- Financial services (customer service) back-office operations creating at least 25 net new jobs

- Agriculture firms creating at least 5 net new jobs

- Manufacturing firms creating at least 5 net new jobs

- Back office firms creating at least 25 net new jobs

- Distribution firms creating at least 50 net new jobs

- Music Production firms creating at least 5 net new jobs

- Entertainment Companies creating at least 100 net new jobs

- Life Sciences Companies creating at least 5 net new jobs

- Other firms creating at least 150 net new jobs and investing at least $3 million

- Firms in strategic industries that make significant capital investment that have at least 25 employees; manufacturing firms who retain at least 5 employees are also eligible to apply for participation in the Program

Businesses must submit an application to Empire State Development (ESD) for a certificate of eligibility, a preliminary schedule of benefits, and a certificate of tax credit for one tax year. To receive a certificate of tax credit for subsequent tax years, the participant must demonstrate to ESD that the entity continues to satisfy the eligibility criteria.

Credits can be claimed up to 10 years, starting with the first tax year for which the taxpayer receives a certificate of tax credit or the first tax year listed on its preliminary schedule of benefits, whichever is later. Failure to satisfy the eligibility criteria in any one year will lose the ability to claim the tax credit for that year.

We know that this program can seem complicated for first-time claimers so we attempted to simplify it into an easy-to-read infographic.

(Click infographic to open in a new tab)

Want to share this image on your site? Please include attribution to https://boast.ai. Thank you!